Houston Ventures, the parent organization of Houston Lighting and Power (HL&P) was separated. In 2003 Houston Ventures was parted into three organizations. The power plants went to Texas Genco, CenterPoint Energy assumed control over the circulation framework, and the retail and discount power business became Reliant Energy . In 2006, NRG Energy purchased Texas Genco from a gathering of private value firms for generally $5.9 billion. A short time later, in May 2009, NRG Energy procured the retail tasks of Dependent Energy. With those two actions, NRG’s property addressed a large portion of the previous HL&P and today serves 1.6 million clients in Texas. The retail activities keep on working under the Dependent Energy name while the old Dependent’s discount tasks became RRI Energy. Following the obtaining of Dependent, NRG broadened its retail impression with the securing of Green Mountain Energy in November 2010. In doing as such, NRG likewise turned into the biggest retailer of green power in the country, giving its Green Mountain and large numbers of everything Dependent clients with energy got from 100 percent sustainable assets.

NRG energy

- NRG Energy finished its obtaining of GenOn Energy in December 2012 for $1.7 billion in stock and money. The GenOn name was resigned in the consolidation, yet the joined organization held GenOn’s Houston base camp to facilitate tasks. That organization, thus, had been shaped out of the consolidation of RRI Energy and Mirant Company in 2010.

- In August 2013, NRG procured Energy Decrease Subject matter experts, a Bison, New York-based Request reaction organization. The details of the arrangement were not unveiled. During Walk 2014, NRG Energy obtained Rooftop Diagnostics Sunlight based (RDS), a private sun-oriented power establishment organization, for an undisclosed sum. RDS base camp stayed in Wall Municipality, New Jersey while they worked under NRG Private Sun-powered Arrangements.

- That very month, NRG additionally gained the retail power business of Domain Assets Inc., which included Texas-based Cirro Energy, and added 600,000 client records to NRG Energy’s retail business. Cirro Energy has kept on working under the Cirro name. In September 2014, NRG gained Objective Zero, a producer of individual sun-oriented power items.

- The next month, NRG Energy procured the private sun-oriented organization Unadulterated Energies Gathering, which zeroed in on electronic client obtaining. This gave work on the sunlight-based reception process as well as a deals channel for Objective Zero. In Walk 2018 NRG gained XOOM Energy, a chiefly private zeroed, retail energy provider with 300,000 RCE clients. The deal cost was $210 million, which remembers working capital and $6 million for exchange costs.

- It was an all-cash exchange that was supported with $75 million from an overabundance of cash and $135 million in the red. NRG Energy expressed that the securing would adjust NRG’s age portfolio in the east. In May 2019, NRG consented to buy Stream Energy for $300 million. The arrangement was settled that August. In July 2020, NRG Energy and Centrica entered an arrangement under which NRG would gain Direct Energy for $3.625 billion in an all-cash exchange. The arrangement was endorsed in January 2021, adding multiple million retail clients across 50 US states and 6 Canadian areas.

Wholesale Generation

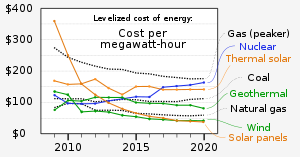

During 2018, NRG Energy sold four of their discount age stages: NRG Yield, Tasks and The board (O&M) business, advancement business, and NRG’s South Focal business. Worldwide Framework Accomplices (GIP) purchased NRG Yield, the O&M business, and the improvement business for $1.375 billion in real money continues. NRG Yield had a different arrangement of energy age including wind, sun-powered, and flammable gas, with an all-out working limit of 5,100 MW. The O&M stage oversaw 2,400 MW of sustainable power in 17 unique states, and the advancement business had 6,400 MW of sustainable age potential open doors in the venture pipeline. GIP and NRG Yield bought the Carlsbad Energy Center flammable gas project (527 MW) and the Buckthorn Sunlight-based project (154 MW) from NRG Energy. Cleco Corporate Possessions bought NRG’s South Focal business for $1 billion in cost and money continues.