The phrase “prevent foreclosure ” is an intimidating one. Losing a home due to foreclosure is a difficult and emotional burden for any homeowner, but there are numerous options available to avoid such a consequence. By taking proactive steps and being aware of potential solutions, homeowners can often successfully prevent foreclosure.

Do Not Ignore the Problem

A common mistake made by homeowners facing foreclosure is ignoring their financial problems. If a homeowner is falling behind on payments, it is crucial to take action as soon as possible. Stopping communication with the lender, or simply pretending that nothing is wrong will only make matters worse. Keeping up communication is essential in finding out about all the available solutions and negotiating reasonable plans. Staying informed is key, so it’s important to stay up-to-date on new laws regulating the foreclosure process.

![]()

Work Out a Payment Plan With the Lender

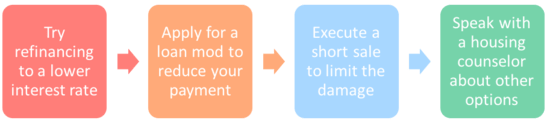

If unsure about their exact financial situation, homeowners can benefit from talking to a loan officer to negotiate special payment arrangements. In some cases, lenders are willing to delay or modify payments while giving the homeowner additional time to get up to date with their finances. Furthermore, certain organizations such as the Federal Home Loan Bank of Atlanta and the Department of Housing & Urban Development (HUD) offer various loan modification programs designed to help homeowners facing foreclosure.

Seek Professional Advice

Hiring a housing counselor or attorney specializing in real estate law can be beneficial if a person wants to prevent foreclosure. An experienced lawyer can inform homeowners of all the options available to them, which may include refinancing their mortgage, selling their home, paying loans with insurance proceeds, and more. Counselors can also assist with filing the proper paperwork and gathering documents needed to apply for different assistance programs.

Look Into Refinancing Options

Refinancing a mortgage could help reduce monthly payments and taxes, allowing homeowners to keep up with the payments. Refinanced mortgages have lower interest rates than conventional ones and they often allow the homeowner to choose between a fixed rate and an adjustable rate. Additionally, obtaining a loan to pay off the current mortgage or using a line of credit could help with covering past due payments.

Explore Short Sale Option

In some cases, a short sale might be a better option than refinancing. A short sale happens when the property owner sells his or her home for less than what is owed on the mortgage. This allows the owner to pay off some or all of the debt, but it also affects their credit score in the process. Before considering this option, however, it’s important to talk to a lawyer or a housing counselor to ensure they receive the best possible outcome.

Rent Out the Property

Renting out the property is another option to consider. Renting the house can help cover up the expenses and maintain control of the property. Additionally, those facing foreclosure who aren’t able to rent out their property can look into renting out rooms or subletting the place. While this won’t pay off all the debts, it can be used to cover part of the mortgage or taxes.

Foreclosure prevention begins with taking action early. Being passive is not the right choice since it can lead to bigger problems in the future. Homeowners that remain informed and seek available resources are more likely to find optimal solutions and successfully prevent foreclosure.